Salesforce vs. Veeva: A Bird’s-Eye View for Life Sciences Leaders

Aug 04, 2025 | 4 min read

Navigating CRM in a Complex Life Sciences Landscape

In the fast-evolving world of life sciences, choosing the right customer relationship management (CRM) platform isn’t just an IT decision—it’s a commercial, clinical, and compliance decision. For pharma, biotech, MedTech, and healthtech organizations, two names dominate the conversation: Salesforce Life Sciences Cloud and Veeva Vault CRM.

While both platforms are widely used and highly respected, subtle differences in flexibility, AI readiness, compliance architecture, and long-term scalability can dramatically impact business outcomes. In this post, we’ll explore those differences from a high-level, operational, and strategic perspective—providing guidance for commercial, medical affairs, and IT leaders tasked with making the right CRM investment.

Understanding the CRM Landscape in Life Sciences

Historically, Veeva was the industry-specific go-to. Its CRM offering, built on top of Salesforce, provided pre-configured compliance workflows and a GxP-ready environment tailored for pharma field reps and medical science liaisons (MSLs). Its intuitive interface and prebuilt modules made it particularly useful for commercial teams focused on sample management, territory alignment, and rep activity tracking.

For many years, this specialization made Veeva the default CRM for regulated medical and scientific engagement. But the CRM needs of life sciences have changed dramatically. Organizations now expect their platforms to unify customer data across channels, automate compliance processes, support virtual and hybrid field engagement, and power advanced analytics—especially in the era of AI.

That’s where Salesforce has taken a leap forward. With the launch of Life Sciences Cloud, Agentforce (Salesforce’s AI-powered digital labor platform), and deep integrations with healthcare data partners like H1, athenahealth, and Box, Salesforce is no longer just a platform provider—it’s a life sciences innovation ecosystem.

This shift has catalyzed reevaluation. Commercial, IT, and medical affairs leaders are increasingly scrutinizing the total cost of ownership, long-term innovation roadmap, and ability to adapt to evolving business needs.

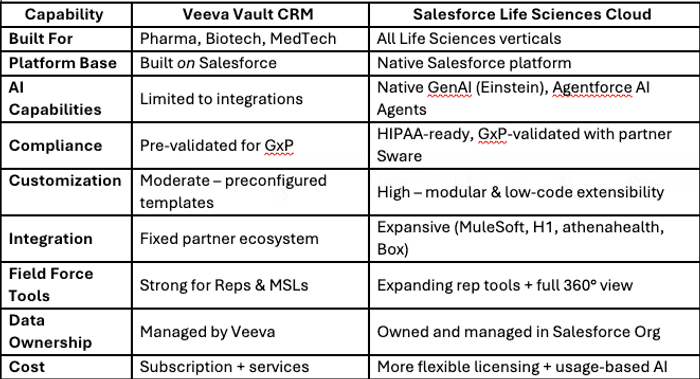

Salesforce vs. Veeva: Core Feature Comparison

Below is a quick summary of how the two platforms stack up on key capabilities.

This table gives a side-by-side reference, but each of these rows represents deeper strategic tradeoffs. Let’s unpack a few of the most critical areas.

Compliance & Data Security: Both Strong, One More Flexible

Both Salesforce and Veeva prioritize compliance, and both have strong records when it comes to regulated environments. Veeva’s pre-validated CRM workflows make it a safe bet for organizations that want turnkey GxP readiness without needing to configure complex compliance frameworks.

However, this also introduces limitations. Organizations with custom workflows or those seeking to scale compliance across multiple geographies and business units may find Veeva’s rigid templates restrictive.

Salesforce, by contrast, enables a flexible compliance model that scales with the business. Life Sciences Cloud includes access to Salesforce Shield, Data Mask, Backup & Restore, and audit trails—alongside partnership-driven GxP validation via Sware. This means compliance can be embedded directly into custom workflows, supporting innovation without sacrificing oversight.

Moreover, Salesforce’s Einstein Trust Layer ensures AI applications meet the highest standards of data governance, consent, and security—critical in an environment where patient and HCP data must be handled with precision.

AI, Integration, and Future Scalability

Salesforce’s most disruptive advantage is in its approach to AI and integration. Agentforce, Salesforce’s proprietary agentic AI solution, allows users to deploy intelligent agents tailored for life sciences use cases—automating everything from clinical trial site selection to field rep coaching.

These agents operate using contextual understanding of healthcare data, meaning they can:

- Preemptively flag compliance risks

- Recommend tailored messages based on HCP preferences

- Monitor formulary changes and payer coverage

- Provide next best actions for reps in real-time

And it’s all built into the existing CRM experience.

Behind the scenes, Data Cloud fuels these capabilities. Structured and unstructured data—from approved claims to KOL insights—can be integrated and harmonized without duplication, reducing data analytics overhead, and unlocking insights that static dashboards can’t reach.

Veeva, while stable and well-suited for focused rep engagement, lacks this level of AI maturity. Its extensibility depends on integrations, not native intelligence. For organizations prioritizing data unification and AI-assisted decision-making, Salesforce is increasingly seen as the more scalable solution.

Cost, Customization, and Long-Term Value

It’s easy to view CRM platforms as an expense—but in reality, they’re a growth engine. The right CRM can increase HCP satisfaction, reduce compliance risk, accelerate launches, and empower field teams to do more with less.

Veeva’s strength lies in its out-of-the-box pharma focus. But that can also come at a price—financial and operational. Updates and configurations often require professional services. Organizations with dynamic business models or complex data environments may find themselves limited by static feature sets.

Salesforce, with its low-code tools and API-driven architecture, supports a more agile model. Teams can:

- Create new workflows quickly

- Modify data models as regulatory needs change

- Launch new business units without re-platforming

In terms of total cost of ownership, Salesforce often proves more cost-efficient in the long run—especially for global teams managing diverse geographies and product portfolios.

Conclusion: Rethinking CRM for a New Era

Both Salesforce and Veeva have legitimate strengths, and the right choice depends on your goals. If your top priority is a turnkey field force CRM with ready-made pharma workflows, Veeva remains a strong contender.

But if your organization is pursuing AI-powered automation, data unification, cost flexibility, and a future-ready commercial platform, Salesforce Life Sciences Cloud offers unmatched scalability and extensibility.

Whether you're in Analytics & Insights, Commercial Ops, Medical Affairs, or IT leadership, the future of CRM in life sciences is about more than tracking calls—it's about enabling smarter, faster, and more connected decision-making across the enterprise.

Want to explore what a Salesforce-powered transformation could look like for your commercial, medical, or field force teams?

👉 Talk to the CI Health team about our Salesforce Services

FAQ

Q: Is Salesforce Life Sciences Cloud compliant with GxP?

Yes, through its validation partnership with Sware and native governance tools.

Q: Can Salesforce replace Veeva?

It depends on your needs. For many life sciences organizations, especially those focused on data, AI, or scalability, Salesforce offers a stronger long-term fit.

Q: Is Veeva built on Salesforce?

Yes, but it’s a customized layer on top of Salesforce, with less flexibility for tailoring or upgrading your tech stack independently.

Q: What if I already use Salesforce for Sales Cloud or Service Cloud?

Salesforce Life Sciences Cloud is built natively and can inherit all capabilities from Sales and Service Cloud, making it easier to scale without re-implementing core systems.

Q: Can Salesforce support hybrid field models?

Yes. Salesforce’s platform supports omnichannel engagement and mobile-ready tools for reps, MSLs, and virtual care teams alike.

Gradial

Gradial  PEGA

PEGA